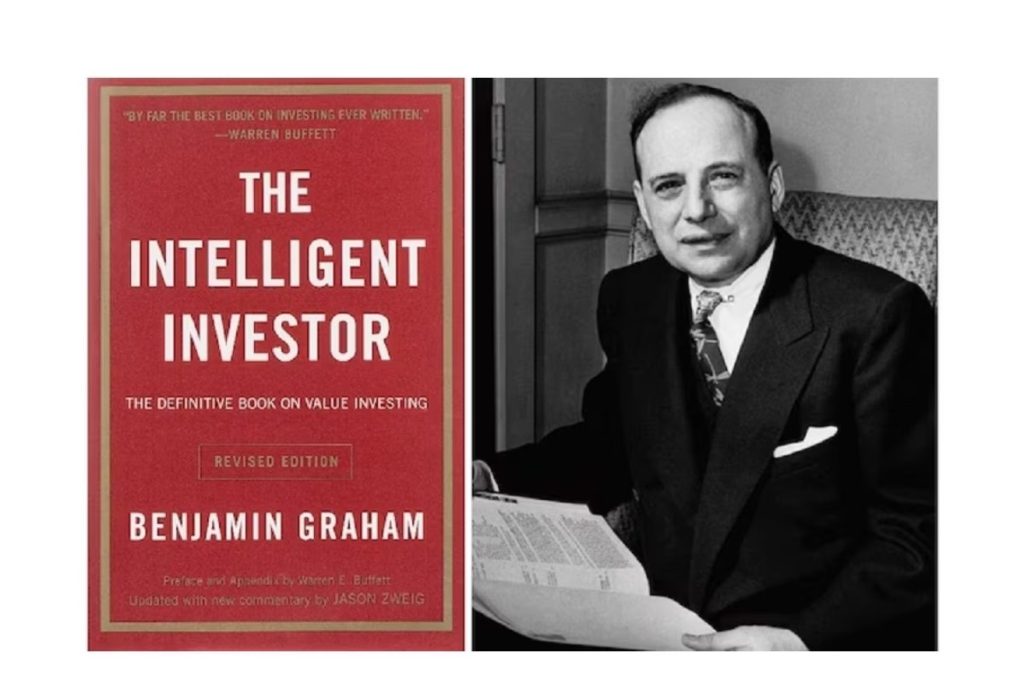

Let’s talk about “The Intelligent Investor” by Benjamin Graham, a book that has left an indelible mark on the world of investing.

1. The Father of Value Investing

Benjamin Graham, an economist and investor, is often hailed as the father of value investing. His seminal work, “The Intelligent Investor,” provides timeless wisdom for those seeking to navigate the stock market intelligently. Here are some key takeaways:

2. Core Principles of Value Investing

- Real-Life Performance Over Market Sentiments:

- Graham’s method advises investors to concentrate on the real-life performance of their companies and the dividends they receive, rather than being swayed by the changing sentiments of the market.

- He emphasized that investors should profit from the whims of the stock market, rather than blindly participating in it.

- Margin of Safety:

- Graham advocated for an investing approach that provides a margin of safety—room for human error—for the investor.

- This means buying stocks when their market price is significantly below their intrinsic value.

- Price-Value Discrepancies:

- Investors should actively seek out price-value discrepancies—situations where the market price of a stock is less than its true worth.

- By evaluating companies with surgical precision, Graham excelled at making money in the stock market without taking big risks.

3. Graham’s Beginnings and Hard-Earned Lessons

- After graduating from Columbia University in 1914, Graham worked on Wall Street.

- Unfortunately, he lost most of his money during the stock market crash of 1929 and the subsequent Great Depression.

- These experiences taught Graham valuable lessons about minimizing downside risk by investing in companies whose shares traded far below their liquidation value.

- His goal was to buy a dollar’s worth of assets for $0.50, utilizing market psychology to his advantage.

- Inspired by these ideals, Graham co-authored “Security Analysis” with David Dodd in 1934, laying the foundation for value investing principles.

4. Influence on Later Investors

- Graham’s ideas continue to resonate with investors, including the legendary Warren Buffett.

- Warren Buffett, often referred to as the “Oracle of Omaha,” considers Graham his mentor.

- Buffett’s investment philosophy is deeply rooted in the principles outlined in “The Intelligent Investor.”

- The book’s emphasis on rationality, discipline, and long-term perspective has guided countless successful investors over the years.

In summary, “The Intelligent Investor” provides a roadmap for navigating the complexities of the stock market. Its principles—grounded in practical wisdom—remain relevant, making it a must-read for anyone interested in value investing.