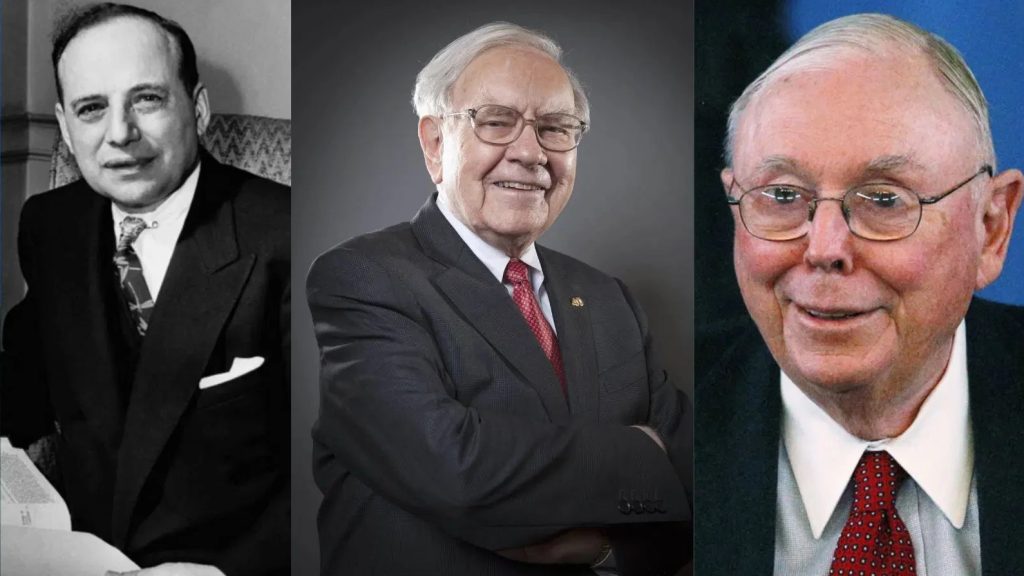

In the vast landscape of investing, few strategies have stood the test of time like value investing. With its focus on buying undervalued assets and holding them for the long term, value investing has produced some of the most celebrated investors in history. Today, we delve into the profiles of three iconic figures in this realm: Warren Buffett, Benjamin Graham, and Charlie Munger, what we know as the value investing legends.

Warren Buffett: The Oracle of Omaha

First and foremost, no discussion of value investing legends would be complete without mentioning Warren Buffett, often hailed as the “Oracle of Omaha.”

Known for his folksy wisdom and unparalleled investment success, Buffett epitomizes the essence of value investing. Transitioning from his humble beginnings, Buffett’s journey to becoming one of the wealthiest individuals on the planet is a testament to the power of patience and discipline in investing.

With a keen eye for undervalued companies with strong fundamentals, Buffett’s investment philosophy revolves around the principle of buying businesses, not just stocks. He famously quipped, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Beyond his investment prowess, Buffett is revered for his philanthropy and ethical business practices, cementing his status as an icon of integrity in the financial world.

Benjamin Graham: The Father of Value Investing

Before Buffett, there was Benjamin Graham, the pioneering figure whose principles laid the foundation for modern value investing.

Graham’s seminal work, “The Intelligent Investor,” remains a bible for value investors worldwide. Transitioning from his groundbreaking theories on security analysis to his emphasis on margin of safety, Graham’s teachings continue to guide investors through market cycles.

Graham’s approach to investing, characterized by a rigorous focus on intrinsic value and a margin of safety, has influenced generations of investors, including Buffett himself, who famously studied under Graham at Columbia Business School.

Although Graham’s methods may seem conservative by today’s standards, his emphasis on discipline, rationality, and the long-term perspective remains as relevant as ever in navigating the complexities of the market.

Charlie Munger: The Partner in Wisdom

Completing the trinity of value investing legends is Charlie Munger, Buffett’s longtime business partner and the vice chairman of Berkshire Hathaway.

Munger’s contributions to the world of investing are equally profound, albeit often overshadowed by Buffett’s spotlight. Transitioning from his multidisciplinary approach to problem-solving to his emphasis on mental models and cognitive biases, Munger’s insights offer a unique perspective on value investing.

Munger’s famous concept of “latticework of mental models” underscores the importance of interdisciplinary thinking in making informed investment decisions. His ability to synthesize insights from various fields, ranging from psychology to economics, has earned him the reputation of a polymath in the investment community.

Beyond his intellectual prowess, Munger’s unassuming demeanor and blunt honesty have endeared him to legions of investors seeking wisdom in an often turbulent market environment.

Conclusion: In the realm of investing, the legacies of Warren Buffett, Benjamin Graham, and Charlie Munger loom large as beacons of wisdom and prudence. Their timeless principles of value investing, marked by patience, discipline, and a focus on intrinsic value, continue to inspire and guide investors worldwide. As we navigate the ever-changing landscape of finance, let us heed the lessons of these legendary figures and strive to emulate their unwavering commitment to intelligent investing.