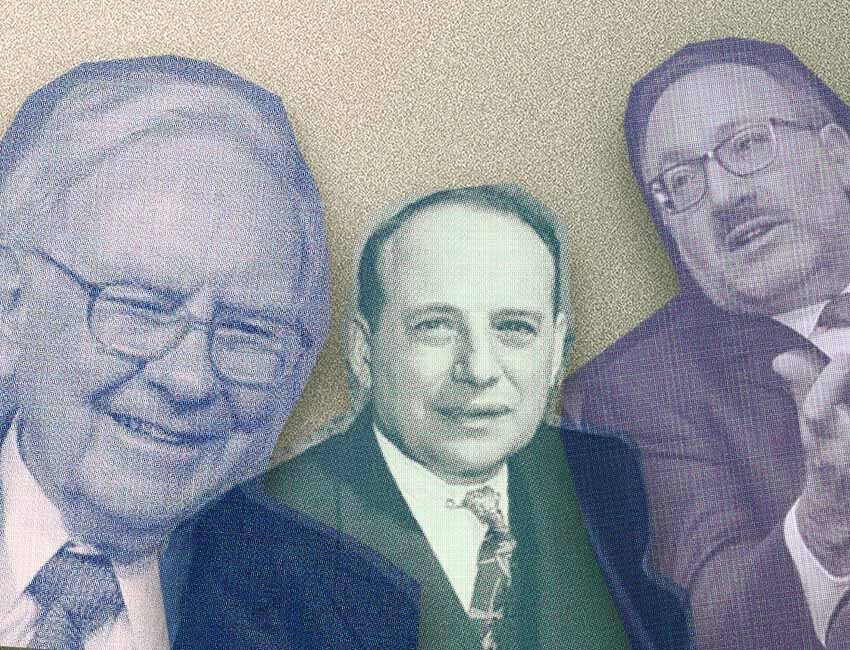

Investing in the stock market can be a daunting task, but learning from the masters of the trade can provide invaluable insights. Legendary value investors like Warren Buffett, Benjamin Graham, and Seth Klarman have made a name for themselves by consistently beating the market through their unique investment strategies focused on finding undervalued companies. Let’s dive into their approaches and see what we can learn from their success.

Warren Buffett’s Long-Term Value Approach

Warren Buffett, often referred to as the “Oracle of Omaha,” is perhaps the most well-known value investor of all time. His strategy is simple yet profound: invest in companies with strong fundamentals that are trading for less than their intrinsic value. Buffett looks for businesses with durable competitive advantages, or “moats,” that can protect them against competition and allow them to maintain high profit margins over time.

He also emphasizes the importance of management quality, believing that even the best business can falter with poor leadership. Buffett’s long-term horizon allows him to weather short-term market fluctuations and focus on a company’s true value.

Benjamin Graham’s Margin of Safety

Benjamin Graham, known as the “father of value investing,” introduced the concept of the “margin of safety” in his seminal work, “The Intelligent Investor.” Graham’s strategy involves buying securities when they are trading significantly below their intrinsic value, thus providing a cushion against errors in estimation or unforeseen market downturns.

Graham preferred quantitative over qualitative factors and often invested in companies with strong balance sheets and little debt. He also advocated for diversification and was a proponent of investing in a mix of stocks and bonds to mitigate risk.

Seth Klarman’s Contrarian Approach

Seth Klarman, the author of “Margin of Safety” and manager of the Baupost Group, is known for his contrarian approach to value investing. Klarman seeks out investments that are not only undervalued but also unpopular or overlooked by the majority of investors. He believes that true value can often be found in areas where others fear to tread.

Klarman is patient and disciplined, often holding cash when he believes there are no attractive investment opportunities available. He also focuses on risk management, always considering what could go wrong with an investment before considering its potential returns.

Conclusion

While each of these legendary investors has their distinct approach to value investing, they all share common principles: a focus on intrinsic value, a disciplined investment process, and a long-term perspective. By studying their strategies and understanding their criteria for selecting undervalued companies, modern investors can learn valuable lessons that may help them achieve success in their own investment endeavors.